Today we're excited to expand Census Enrichment through our partnership with S&P Global Market Intelligence - read our formal press release here!

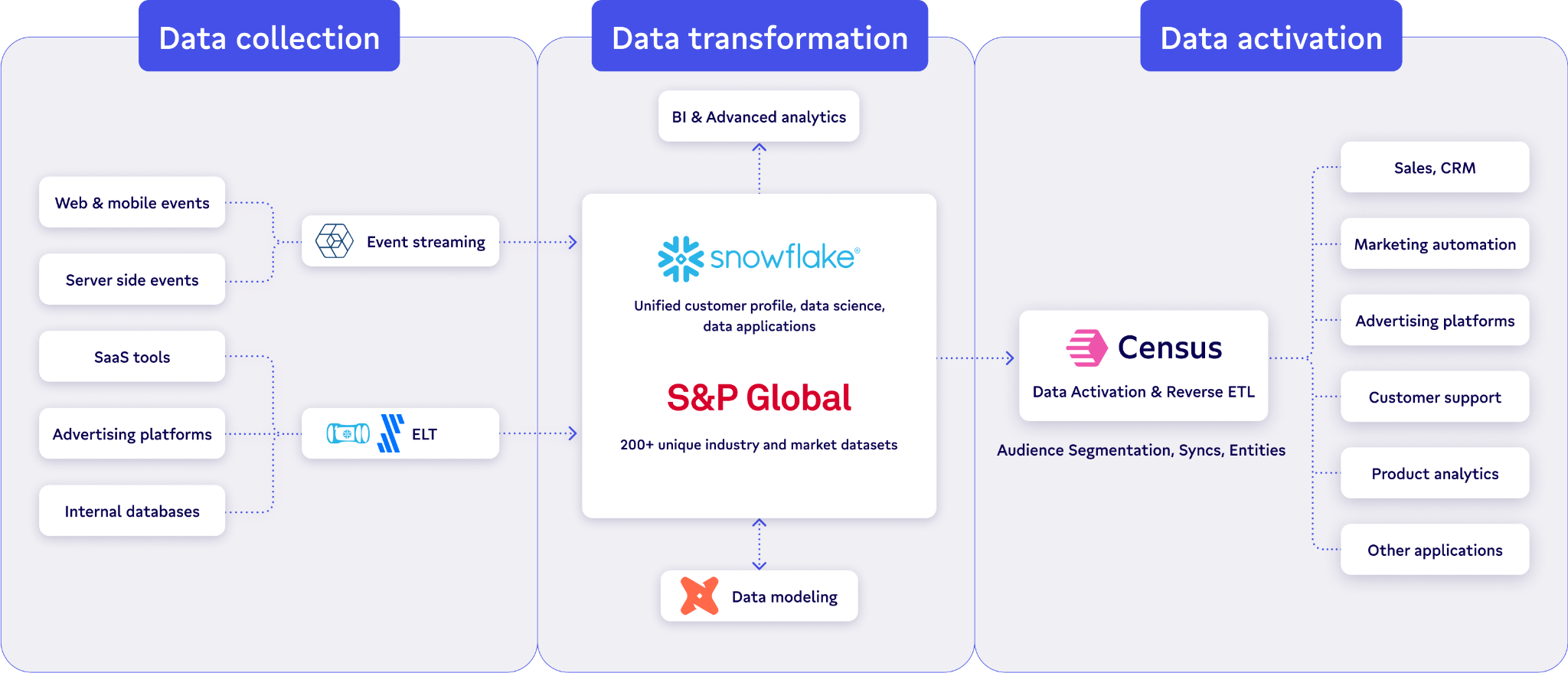

S&P Global serves 99% of the Fortune 500 and has over 13,000 customers worldwide. By tapping into S&P's data on the ❄️ Snowflake Marketplace, Census enables enterprises to centralize insights in the Data Cloud, then easily enrich 200+ business tools with S&P's Market Intelligence. With just a few clicks, companies can sync premium financial and research data into downstream sales and marketing tools and change how their business teams operate.

Market Intelligence takes enrichment to another level with 200+ third-party datasets

S&P Global Market Intelligence is a division of S&P Global (NYSE: SPGI) and is the world's foremost provider of credit ratings, benchmarks, analytics and workflow solutions. Rather than worry about cleaning complex company and market data, Market Intelligence provides trusted data solutions so companies can uncover insights and make decisions to drive their business forward.

Their open-access platform and proprietary S&P Global IDs allow visitors to explore and bridge together traditional and alternative datasets, such as Company Intelligence, Transaction, Professional, ESG, and Bank Regulatory data. By using Market Intelligence with Census, users can easily enrich their CRM with more context around company financials, funding, employee count, research signals, and more. Go-To-Market teams can quickly identify sales opportunities, route and score sales leads, and tailor client outreach.

Market Intelligence is transforming how businesses operate — how will it help you?

Third-party data can provide an extra leg over your competition in today's competitive sales environment, where operations are lean and financial targets are lofty.

We're adamant about helping enterprises take action with their Customer 360 source of truth. Having S&P Market Intelligence in Snowflake is an essential first step, but making those insights actionable in downstream business tools empowers more relevant sales conversations, marketing personalization, and higher conversion rates.

Here are a few use cases to draw inspiration from:

Financial Institutions Better Qualify Sales Opportunities in Salesforce

It's relatively straightforward for a bank or credit union to capture first-party data on how often clients deposit funds or inquire about loans. These are all direct behavioral data points regarding the usage of bank services, information usually stored in a CRM such as Salesforce.

But what if the bank's sales department wants to cross-sell other financial offerings? The outbound strategy and messaging tactics for a highly qualified customer can (and should) differ significantly from lower qualified prospects. However, data available in the CRM can be limited, making it difficult for a sales manager to decide which clients are the most suitable for outreach.

By layering in context regarding financials, such as company funding, revenue, and valuation, on top of the first-party behavioral data, financial institutions can craft more informed sales strategies such as:

- Alerting account representatives proactively when it's time to engage clients.

- Cross-referencing behavioral metrics to have more relevant conversations based on demonstrated usage needs.

- Building account scoring and propensity models with first-party and third-party signals.

Enriching Salesforce with company growth indicators supercharges sales operations with deeper insights and makes cross-sell initiatives more effective for financial institutions.

Law Firms Track Market Activities to Uncover New Engagement

To best serve their clients, professional services teams need a comprehensive 360° view of both internal and external insights. Solutions and services are not one-size-fits-all, so it's imperative that legal professionals have up-to-date data for the most informed conversations.

For example, a law firm negotiating corporate transactions needs market intelligence on mergers and acquisitions, venture capital, and private company financials. With S&P Global and Census, firms can easily subscribe to in-depth market intelligence and make it available for sales and marketing operations.

In addition to empowering existing client conversations, professional services firms can use S&P and Census to find and target new customer segments with personalized marketing. Some examples include:

- Initiating email campaigns based on corporate growth signals, like a 25% increase in headcount in the last three months.

- Alerting business acquisition teams about new funding rounds in Slack or Microsoft Teams, for timely outreach.

- Communicating new service offerings to only relevant clients, instead of contacting the entire subscriber list.

With the most granular insights into company transactions and financials, professional services firms can transform how they deliver timely and relevant consultations.

Activating Market Intelligence is a breeze with Snowflake Marketplace + Census

Snowflake Marketplace allows users of the Data Cloud to quickly discover and access third-party data and services (along with a host of other features). It provides secure access to trustworthy data listings from providers such as S&P Global, so that data consumers feel comfortable enriching their first-party data. By combining first- and third-party data in the Data Cloud, you can fill in the gaps and build a more complete picture of your customers and prospects.

As a Powered By Snowflake Partner, Census seamlessly functions with Snowflake Marketplace and syncs relevant customer data to customer-facing business tools. With greater data accessibility, business teams can power new use cases and campaigns in best-in-class tools like Salesforce, HubSpot, and Marketo.

💡For more information on setting up S&P Market Intelligence enrichment in your Census account, please contact our team here!

❄️ Attending Snowflake Summit? Secure your spot here for our joint workshop and learn how to leverage Market Intelligence for your business!